UK Stamp Duty Calculator

Stamp Duty Land Tax (SDLT) is a progressive tax levied on the purchase of freehold, leasehold, or shared ownership residential properties in England and Northern Ireland. The tax is calculated based on the portion of the purchase price that falls within each applicable tax band. The current rates came into effect on 1 April 2025 and supersede all previous schedules.

Disclaimer: This calculator provides estimates for reference only and should not be considered as official advice or final figures. Final amounts may vary due to changes in property values, tax rates, fees, or other individual circumstances. We strongly recommend consulting a qualified solicitor or financial advisor before making any financial commitments.

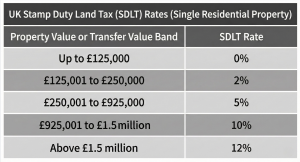

1. Stamp Duty Land Tax (SDLT) rates when owning a Single Residential Property

Stamp Duty Land Tax (SDLT) is payable at the rates below if the purchased property will become your SOLE residential property owned worldwide. Purchasers who already own another residential property typically incur an additional 5% surcharge on top of these rates.

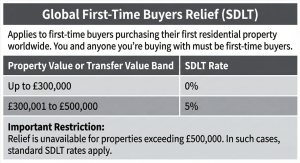

2. Stamp Duty Land Tax (SDLT) Rates for First-Time Buyers Purchasing Their First Home in the worldwide

If you are a first-time buyer acquiring your first residential property (worldwide), the following Stamp Duty Land Tax (SDLT) rates apply. You’re eligible if you and anyone else you’re buying with are first-time buyers.

You’ll pay:

*First-Time Buyer Relief is unavailable for properties exceeding £500,000. In such cases, standard Stamp Duty Land Tax (SDLT) rates and rules for non-first-time buyers apply.

Example :

If you are a first-time buyer and purchase a property for £500,000. You intend to occupy the property as your main residence. The Stamp Duty Land Tax (SDLT) will be calculated as:

- 0% on the first £300,000 = £0

- 5% on the remaining £200,000 = £10,000

- total Stamp Duty Land Tax (SDLT) amount = £10,000

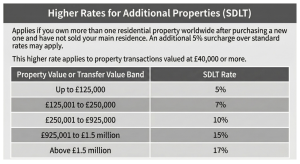

3. Stamp Duty Land Tax (SDLT) rates for Second Homes or Buy-to-Let Properties

Purchasing a new residential property may require you to pay an additional 5% surcharge on top of standard Stamp Duty Land Tax (SDLT) rates if the purchase results in you owning more than one residential property.

When the higher rates apply:

You must pay the increased Stamp Duty Land Tax (SDLT) if:

- The property costs £40,000 or more.

- You (or your spouse/civil partner) will own more than one residential property worldwide valued at £40,000 or more after the purchase.

- You have not yet sold or transferred ownership of your previous main home.

- The property is not subject to a long-term lease (over 21 years remaining) held by another party.

Rules for married couples or civil partners:

Both individuals are treated as joint buyers under these rules, even if only one party already owns a property. The higher Stamp Duty Land Tax (SDLT) rates apply to the entire transaction unless you are permanently separated.

The rates for second homes or buy to let properties from 1 April 2025

Example

If you already own a home as your primary residence and purchase another residential property for £350,000 after 1 April 2025, becoming the owner of multiple properties after the transaction, the Stamp Duty Land Tax (SDLT) payable on the new acquisition will be determined as follows :

- 5% on the first £125,000 = £6,250

- 7% above £125,000 and up to £250,000 = £8,750

- 10% on the final £100,000 = £10,000

- Total Stamp Duty Land Tax = £25,000

4 . Stamp Duty Land Tax (SDLT) Rates if you’re not a UK resident (Non UK Resident)

If you spend fewer than 183 days (six months) in the UK within the 12-month period preceding your property acquisition, you are classified as a non-UK resident for Stamp Duty Land Tax (SDLT) purposes. Purchasing a residential property in England or Northern Ireland under these circumstances generally incurs an additional 2% charge, though exemptions might apply depending on the property type, nature of the transaction, or specific buyer qualifications.