英国印花税计算

印花税土地税 (SDLT) 是一种累进税,对在英格兰和北爱尔兰购买永久产权、租赁产权或共有产权住宅物业征收。税额是根据购买价格中属于各个适用税级的部分计算。现行税率已于 2025 年 4 月 1 日生效,并取代所有先前的税率表。

免责声明:本计算器提供的估算值仅供参考,不应被视为官方建议或最终金额。最终金额可能会因房产价值、税率、费用或其他个人情况的变化而有所不同。我们强烈建议您在做出任何财务决定之前咨询合格的律师或财务顾问。

1. 拥有单套住宅物业的印花税(SDLT)税率

如果所购买的房产将成为您在全球范围内拥有的唯一住宅房产,则应按以下税率缴纳印花税(SDLT)。已经拥有另一处住宅物业的购买者通常需在这些税率的基础上额外缴纳 5% 的附加费。

税率-300x162.png)

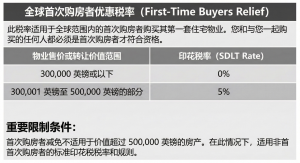

2. 全球首次购屋者购买第一套房屋的印花税 (SDLT) 税率

如果您是首次购置住宅物业(全球范围内),则适用以下印花税税率。如果您和与您一起购买的人都是首次购屋者,您就有资格。

您将支付:

*首次购屋者减免不适用于价值超过 50 万英镑的房产。在这种情况下,适用非首次购屋者的标准 印花税税率和规则。

例子 :

如果您是首次购屋者,并购买了价值 500,000 英镑的房产。您打算将该房产作为您的主要住所。 你的印花税(SDLT)计算方式如下:

- 300,000英镑以下的 0% = 0 英镑

- 剩余 200,000英镑的 5% = 10,000 英镑

- 总印花税 = 10,000 英镑

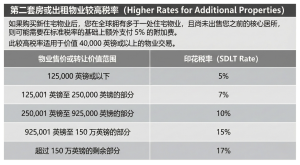

3. 第二套物业或出租房产的印花税 (SDLT) 税率

如果您购买新住宅物业后拥有多于一处住宅物业,则可能需要在标准印花税(SDLT) 税率的基础上额外支付 5% 的附加费。

如果出现以下情况,而您购买价值 40,000 英镑或以上的住宅物业(或其中的一部分),则必须缴纳更高的印花税(SDLT)税率:

- 购买后,您(或您的配偶/民事伴侣)将在全球拥有多处价值 40,000 英镑或以上的住宅物业。

- 您尚未出售或转让之前主要住所的所有权。

- 该房产不属于其他方持有的长期租约(剩余租期超过 21 年)。

- 已婚夫妇或民事伴侣的规则:

根据这些规定,即使只有一方拥有房产,双方仍将被视为共同买家。除非您永久分居,否则更高的印花税税率将适用于整个交易。 (除非你们永久分居)

例子 :

如果您已经拥有一套房屋作为主要居所,并在 2025 年 4 月 1 日之后以 350,000 英镑的价格购买另一处住宅物业,从而在交易后成为多处物业的所有者,则新购置物业应缴纳的印花税(SDLT) 将按以下方式计算:

- 首 125,000 英镑的 5% = 6,250 英镑

- 125,000 英镑以上至 250,000 英镑的部分,税率为 7% = 8,750 英镑

- 最后 100,000 英镑的 10% = 10,000 英镑

- 印花税总金额 = 25,000 英镑

非英国居民的印花税(SDLT)税率 (Non UK Resident)

如果您在购买房产之前的 12 个月内在英国居住的时间少于 183 天(六个月),则出于印花税 (SDLT) 的考虑,您被归类为「非英国居民」。在这种情况下,在英格兰或北爱尔兰购买住宅物业通常需要额外支付 2% 的费用,但根据物业类型、交易性质或特定买家资格,可能会有豁免。